THE TRAVAILS OF SIERRA LEONE'S CENTRAL BANK - THE BANK OF SIERRA LEONE

Today Wednesday August 4 is the

46th anniversary of the launching of Sierra Leone's first national currency -

the leone. As the

Bank's website stated the authorities at

the time, were of the view that as a part of concretising true independence as

well as accelerating economic activity in the new nation's interest, it was time

for the country to have its own notes and coins. This effectively meant that the

leone and cent would now replace the West African Currency Board denominations

which were in use in the British colonies of Nigeria, Ghana, the Gambia and our

very own mother country Sierra Leone.

This website with some interesting facts about currency and monetary use along the coast of West Africa has noted that:-

The British West African Currency Board was constituted in 1912 to control the supply of currency to the British West African Colonies...The criteria for an ideal currency is that it is hardy, long lasting, easy to count, difficult to counterfeit, it is portable, durable and easy to recognize. Consequently there were few rivals to precious metals except cowrie shells! They represented the shillings and pence of the West African culture, the pounds being represented by higher value merchandise such as gold. By the nineteen twenties cowries had virtually disappeared from main trade, the British silver coin was accepted together with 1/10 penny and penny...Based on the fact that by 1910 the amount of silver coinage in circulation in the West African Colonies Nigeria, Gold Coast (Ghana), Sierra Leone and Gambia was almost equivalent to that in circulation in the United Kingdom and given the fact that cash transactions had practically replaced barter the British Government requested a committee to look into the best currency policy for the West African Colonies. The Board recommended issuing paper money determined that the first paper issues bearing the name of the Currency Board would be a 2/- ,10/- and 20 shillings. One centre Lagos would initially be used for circulation.

And so after 46 years, what has the Bank of Sierra Leone done to improve the country's economy? How effective has it been in regulating banks operating within the borders of Sierra Leone and more importantly in all these years, has the country's banker of bankers escaped unscathed, unscarred by the country's corrupt leaders and manipulators? Read some of the facts at hand and decide how useful the Bank of Sierra Leone had been in helping the country's economy stay on a firm footing or slide downwards.

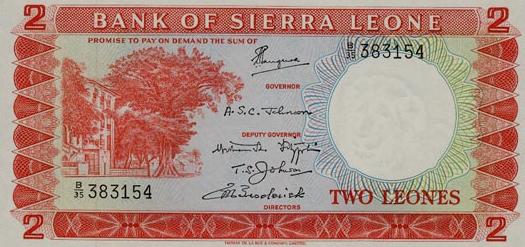

First things first. Our national currency was issued for the first time in 1964 with one Gordon Hall as the Governor with denominations of one and two leone currency notes being the most popular with the ordinary man in the street. There were the half, one, five, ten and twenty cent coins to complete the line-up with the five leone note a preserve of businesses and certain privileged and respected members of society.

That was in 1964 at a time when the two leone note was equivalent to the British pound and was legal tender that was readily accepted in UK outlets. The Head of State then was Prime Minister Sir Milton Margai the father of the nation and leader of the Sierra Leone People's Party, the SLPP.

In 1968, after a series of political upheavals during which Sierra Leone experienced it's first military take-over by then head of the army, the late David Lansana, Siaka Stevens the declared winner of the 1967 General Elections took over the reins of government promising a new and progressive Sierra Leone with equal opportunities for all.

When he took over the currency was

as strong as ever and was effectively linked to the UK British pound (£) with

reserves held in that country that ensured a stable economic climate.

By the time, the APC was kicked out by their very own hand-picked original recruits in the army twenty four years later on April 29 1992, the national currency had become so devalued that it's smuggling across borders became a way of life with traders who would not be bothered with a system that was steeped and reeked of massive corruption.

The first signs that things were not going well was the exchange rate for the US dollar on the markets in Sierra Leone. Hitherto the dollar was worth about 75 cents of Sierra Leone money, it soon climbed to one leone to the dollar with some waving this off as just a little skew in the economy.

Things began to look a bit not-so-rosy when then Finance Minister C A Kamara-Taylor under the Stevens regime announced that the fast-depreciating leone would now be linked to what he called the SDR, Special Drawing Rights, which was explained by the government as something good for the country which had now attained the status of a Republic. "We are now in complete control of our own economy and no longer have to get tied to the currency of our colonial masters", they glibly lied to the public who had started to raise doubts about the government's economic policies. The SDR and the de-linking of the leone from the British pound and the dollar by extension were also justified at a time when the UK currency was experiencing slight fluctuations.

This table showing the fortunes of the leone tells the story of an economy in freefall with those in charge not caring about their action on fellow citizens and the welfare of the people.

The story of the Bank of Sierra Leone reflects the politics of the time and the mismanagement in both governance and the economy with the Central Bank at one stage engulfed in massive corruption when investigations showed just how corrupt the institution had become.

The credibility of the Bank of Sierra Leone hit rock-bottom when it was revealed that cheques that had been defaced (tip-exed) and written over were honoured by officials at the bank. In some cases, cheques and vouchers were recycled and payments paid by the bank from the same defaced documents.

At another time, it was revealed and exposed by the police of Central Bank officials recycling (putting back into circulation) currency that had been withdrawn from circulation and was meant to be destroyed!!!!!

It is an open secret that things really got to a head in corruption and bad governance during the Momoh era when he instituted the infamous New Economic Order, a cover for massive corruption and the hounding of people thought to be a threat to the government.

While government and APC party officials dealt openly in currencies that were no longer available at the Central Bank but in business outlets of officials, Sierra Leoneans can still recall how commercial banks were unable to pay out monies from accounts of their customers!!!

They can still recall those

bundles of filthy and mouldy 5-leone notes, covered in all manner of dust that

changed hands, with people not caring to count individual notes for fear of

inhaling noxious fumes from them.

It was a time for some commercial bank managers as well as the Central Bank to make a killing as they decided what customers should get when demands are made for such events like funerals and other urgent matters needing money from their own bank accounts. It was an economic and social nightmare!!!

Among those who acted as Finance Minister during the most corrupt days of the APC government under Joseph Saidu Momoh was one Hassan Gbassay Kanu. There were stories doing the rounds at one time that he had the local currency stored in drums ready to be smuggled abroad. When the Momoh government was sent packing by the khaki boys who set up Commissions of Inquiry to look into the activities of the ousted government, he thought he saw the right opportunity to air his side of what happened then that generated the story.

This is a part of his submission to the Beccles Davies Commission as he tried to explain a system that had got rotten to the core

"There was a time when the leone was one leone to one dollar. Then we devalued, until eventually we floated in June 1986 at nineteen leones. When we floated at nineteen leones Government was able to put enough currency in the system only to take care of the transactions requirement of the exchange rate at nineteen leones. Therefore, when during the floating the leone depreciated to fifty five leones to one dollar we were not as a Government able to put currency in the system to take care of the transactions requirement at an exchange rate of fifty five leones to one dollar. So we had that gap.

We had ordered five billion worth of currency from De La Rue of Fifty leones and one hundred leones. Not a single cent from them had come. I have a minute here from the Governor of the Bank of Sierra Leone to me, telling me that the money "was not coming and the currency was short because we owed De La Rue Six Million United States Dollars which we had to pay; and that if we did not pay, the money would not come". So my adversaries that I have named, used this to discredit me.

The Momoh regime could be stated to be the worst when it came to governance and economic management as he took over at a time when the country was in dire straits and needed a leader with a will to bring the country back from the brink. Indeed as one commentator noted.

....Momoh ignited widespread hope, promising a “new order”. Momoh tried to regain control of Sierra Leone’s diamond resources from Stevens’ clients. Creditors approved, noting that the main obstacle to fighting corruption and servicing foreign debt in Sierra Leone was the hold over diamond resources exercised by rogue state officials and Stevens’ business clients (Reno 1998). Creditors recommended inviting foreign firms to regularise or impose control over diamond mining (Reno 1998).

However, the “foreign firms” that showed up were generally shady businessmen with criminal links. They received generous diamond mining and other concessions in return for their offers of “assistance”. LIAT appeared in 1987 with promises to finance and build development projects in return for diamond mining concessions.

The firm’s chief was arrested in the US on fraud charges and extradited to Israel to face additional charges. This ended LIAT’s Sierra Leone operations (Reno 1998).SCIPA Finance appeared in 1989 with an offer to manage Sierra Leone’s diamond mines. SCIPA paid overdue civil servants’ salaries and also allegedly paid a portion of Sierra Leone’s arrears with conventional creditors, helping to put debt negotiations with the IMF back on track in 1989 (Reno 1998). However, SCIPA was primarily interested in purchasing Sierra Leone diamonds as part of a money laundering operation. To dominate the market SCIPA cultivated a following among illicit diamond operators, and gave gifts to Momoh’s allies and rivals alike (Reno 1998). SCIPA’s head was arrested for “economic sabotage” in 1989, thus ending SCIPA’s operations (Reno 1998).

The government initiated a structural adjustment programme in June 1986, agreeing to float the exchange rate, remove subsidies on rice and petroleum, liberalize trade, increase producer prices and pay US$3 million in arrears to the IMF. Paris Club creditors agreed to reschedule Sierra Leone’s immediate debt obligations. However, the government failed to implement the agreed measures and decided to return to an exchange rate peg in August 1987. The IMF withdrew its financial support. Sierra Leone was declared ineligible to use IMF resources and threatened with suspension from Fund membership for failing to service its foreign debt (Funna 1993).

And today, thanks to the destruction of a firm foundation inherited in 1968, Sierra Leone is still grappling with the problems of the past - a process made even more difficult by corrupt government officials and party functionaries whose sole aim is for self and relations with the mother country occupying the bottom rung in their list of priorities.